Budget tug of war means pension cuts

What is in this article?

Meeting obligations still an issue

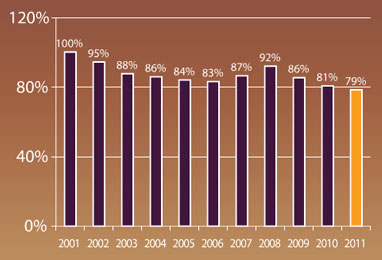

As a result of the sharp declines in the financial markets after the financial collapse in 2007, the estimate of assets set aside to cover the promised benefits has fallen from 87 percent in 2007 to 76 percent in 2011 for state plans and from 81 percent in 2007 to 72 percent in 2011 for local plans, according to the 2012 SLGE report.

Pension plans are not just a far-off liability that must be paid for “some day” in the future. For each budget year, actuaries also figure how much must be paid to meet the obligation — and that cost has also been soaring. According to the SLGE report, the annual contribution as a percent of payroll has risen from 11 percent to 14 percent for state governments and from 20 percent to 25 percent of payroll for local governments.

These ever-increasing costs have had a dramatic effect on certain local governments. Munnell’s book calls out several examples of perils that befall communities that fail to rein in costs:

These ever-increasing costs have had a dramatic effect on certain local governments. Munnell’s book calls out several examples of perils that befall communities that fail to rein in costs:

Vallejo, Calif. – The city of 116,000 filed for bankruptcy in May 2008. Reasons for the filing are largely attributed to excessive compensation for police and fire union members;

Prichard, Ala. – The city of 22,000 filed for bankruptcy in October 2010, citing the legislature’s sweetening benefits of the municipal pension plan without paying for them;

Central Falls, R.I. – The city of 19,000 filed for bankruptcy in August 2011, after failing to negotiate significant concessions from the unionized workforce, which would have required reductions in pension benefits by as much as 55 percent.

Even today, a number of plans are frequently cited for their severe underfunding. In Illinois, for example, state legislators have been unable to fill the state’s $95 billion pension hole. The governor argues that $17 million is added to the unfunded pension liability every day. And New Jersey’s pension plan was 60.8 percent funded as of June 30, 2011, despite a number of benefit cuts already absorbed by workers, according to Fitch Ratings, an investment advisory service.

The good news is that, under likely market conditions the combined ratio of local and state funding, in aggregate, should gradually arise to 82 percent by 2015, according to Munnell’s CRR estimates. A great deal of the credit for that improved picture can be attributed to pension reforms, which have reduced promised benefits and allowed rising investment returns to begin to cover a greater share of the cost.

A recent NIRS study pointed out that the most common plan modifications include increased employee contributions; reduced plan benefits for new hires; increased retirement ages and service requirement (for new employees); and cost of living adjustment (COLA) reductions for retirees and existing workers.

While at the height of the financial crisis, many politicians proposed their government close the defined benefit plans and move to defined contribution (DC) plans. But the report notes that no state has shifted to a DC-only plan since 2005. (DC plans shift the final benefit risk to the individual worker’s investment and saving performance.)

Revisiting revisions predicted

The report argues that governments became reluctant to convert from DB plans to DC plans as they recognized DB plans offer professional management and cost savings, compared to DC plans. In addition, accounting rules force the government to significantly increase its immediate funding to the DB plan during the transition. However, the report notes that a number of plans have instituted mandatory hybrid arrangements combining a reduced DB benefit with a DC plan.

Keith Brainard, the research director for the National Association of Retirement Administrators, believes many governments made changes as a reaction to the dire fiscal conditions created by the financial crisis. “I wouldn’t be surprised if some plans revisit their reforms of the last few years,” he says. “They may readjust the pension plan designs to better fit their longer-term objectives.”

Brainard argues there is a growing appreciation for the flexibility of DB plans, which translates to huge savings over the long term from small “tweaks” in a program. “There’s enhanced appreciation that pension plan adjustments can meet changing circumstances,” he says. “You don’t have to throw out the baby with the bath water.”

Boyd, from the Rockefeller Center, argues that the nation’s pension systems are a “mixed picture” with some plans still faltering badly. Even where improvements in the overall picture for pension plans have been made, the revised outlook rests on what he considers “optimistic” investment assumptions.

“If we had another period like 2008 and 2009, things would quickly deteriorate,” he says. Most plans still base their assumptions on investment returns of 7.5 to 8 percent annually and are taking higher risk in their investments in order to meet their objectives. In fact, some economists argue that the return rate should be pegged at 4 percent, raising liabilities by trillions of dollars.

“Professional managers, by and large, have good judgement on how to invest when someone else tells them what risk to take,” he says. “But taxpayers don’t have a say. They don’t necessarily want two-thirds of these investments in equities. There’s lots of risk borne by taxpayers.”

When I came to local

When I came to local government from the private sector almost 30 years ago, I took a 30% pay cut, plus I had to contribute 5% of my pay to the pension to work in local government. In part I did it because I wanted a little more of my life back since I was working 12 to 16 hour days at least 6 days a week. For the most part, with local government I work only 10 hour days, 5 days a week as a salaried professional. Yes, the pension was part of my calculus in taking a job in local government. As recently as 2008, I was offered more than twice my current salary to go work in the private sector. There is pressure to reform our pension system to require a bigger contribution from the employees along with a smaller yearly accumulation for years of service. I am in my mid 60’s and feel beat up by the system, the work, and the hatred we are feeling from the public. Trying to look back, I am not sure I would have taken the job with the new pension requirements. I could have made much more in the private sector and saved all the bonuses and extra pay I got in the private sector which I do not get in the public sector. Up until the last 4 or 5 years, my colleagues in the private sector said I was just plain stupid to work here. Now, the ones the did not save, may be slightly jealous I may have some sort of pension in a few years. Of course, there is no way to know, but the calculus of coming to work here perhaps was not the right choice.